< Back

LREG's Southeast Expansion Paves the Way to 5,000 Door Goal

LREG's Southeast Expansion Paves the Way to 5,000 Door Goal

LREG Investments, a vertically integrated real estate firm, has been the Northeast's leader in multifamily property development and management for over 17 years. As we continue to face an extremely competitive market in the Northeast, and a dwindling number of multi-family investment opportunities, we're reminded of when we first identified what would become a massive demographic shift towards the Southeastern U.S.

Today, we're well on the way to our 5,000 door goal, but the journey hasn't been without dedication and plenty of repositioning along the way.

Read on to discover how we've stayed ahead of our competitors by embracing new challenges and pursuing new opportunities in the Southeastern United States.

Market Research Points to the Southeast

Back in 2011-2013, as strains in the Northeast housing market developed, we noticed a shift in demographics towards cities in the Southeastern United States. The region's workforce was booming, and our research and data demonstrated that large Fortune 500 companies along with logistics, healthcare, technology, and financial industries were expanding and transplant employees to large metropolitan areas such as:

- Atlanta and Savanah, GA

- Charlotte, NC

- Huntsville, AL

- Jacksonville, Orlando, Tampa, and Miami, FL

- Richmond, VA

Identifying New Opportunities and Assessing Risk

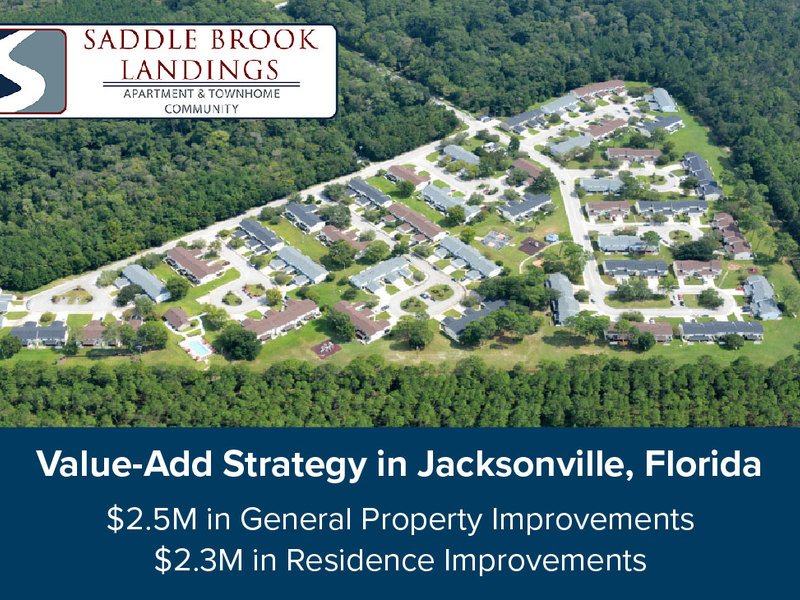

Coincidently, we were presented with an opportunity to purchase former military housing comprised of 195 3 & 4-bedroom townhomes on eighty-eight acres in Jacksonville, Florida. The project presented many favorable attributes for a significant value-add opportunity. Furthermore, the United States Navy (the seller) was an entity that we were very familiar with and understood while many of our competitors looking at the asset did not have the same experience, patience, or knowledge to execute a purchase from this branch of government.

We knew capital raising for the asset would pose a challenge for us, as our typical investors were uncomfortable with the distance the property was from our northeast assets, along with their lack of knowledge of submarket and acquisition process from the US Navy. However, we were able to connect with a middle market institution who coincidently was also entering the Southeast market, specifically Jacksonville. This investor aligned with our thinking on the risk versus reward benefit of the project and the potential for a large payout when we completed the execution of our tried-and-true property repositioning and renovation plan. This involved leveraging our organization and transferring a Property Manager and Assistant Property manager to execute the project.

Putting Our Value-Add Strategy to the Test

Upon takeover of the multifamily property in Jacksonville, Florida, we implemented our resident systems, financial and accounting systems and started renovations immediately.

General property improvements included:

- Addition of new entry monument and property signage

- New sewer system and roofs throughout the property

- New Leasing Center, fitness area, swimming pool & dog park

- Landscaping and parking improvements

- Renovated basketball court and on-site playground

Residence modifications and improvements included:

- New appliances, kitchen/bathroom cabinets, countertops, and sinks

- New siding, shutters, and garage doors with power lifts on all homes

- New washer/dryers in 100% of units

- New carpet and engineered hardwood flooring

- New plumbing and lighting fixtures

- New trim, interior doors, paint

- New HVAC systems

These $6M in renovations were completed by our construction and development team members over the course of 24 months. The result? Our operations team was able to reach 95% occupancy within just 12 months.

The acquisition was structured to provide 9% cash on cash preferred distributions day one, paid out quarterly.

Looking Forward to Growth and Expansion

Today, Saddle Brook Landings is a well-maintained community with improved common area amenities such as playgrounds, dog parks, an outdoor pool and a fitness center. The property consistently operates at 93%-95% occupancy and in 2023 generated a 19.5% cash on cash return paid in quarterly distributions for our investors. As a long-term hold, Saddle Brook Landings is slated for a complete $2.7M exterior renovation in 2027 along with planned interior renovations on an as-needed basis.

What's next? We plan to utilize our position in Jacksonville to expand our geographical footprint in the Southeast. In addition to the leasing of our brand new two-bedroom homes in Jacksonville, the construction of our newest development in Tampa is well underway. We can't wait to update you as we continue to make progress on this exciting project!

Don't forget to connect with us on LinkedIn to join the conversation and stay updated on all things LREG Investments.